Written by:Octave Trust Bank

October 24, 2022

Under the Biden-Harris Administration, federal student loan borrowers in the working and middle classes can receive up to £20,000 in loan forgiveness. As pandemic-related support expires, this program is designed to help students transition to regular payments. The student debt relief plan is broken down into 3 parts. Here are the details for each.

Part 1: Final extension of student loan repayments

The final extension of student loan repayment will be through December 31st, 2022. Payments will resume no later than June 2023.

Part 2: Providing debt relief to low- and middle-income families

To smooth the transition back to regular repayment, the U.S Department of Education is providing up to £20,000 of student debt forgiveness to over 8 million borrowers who are eligible to receive relief.

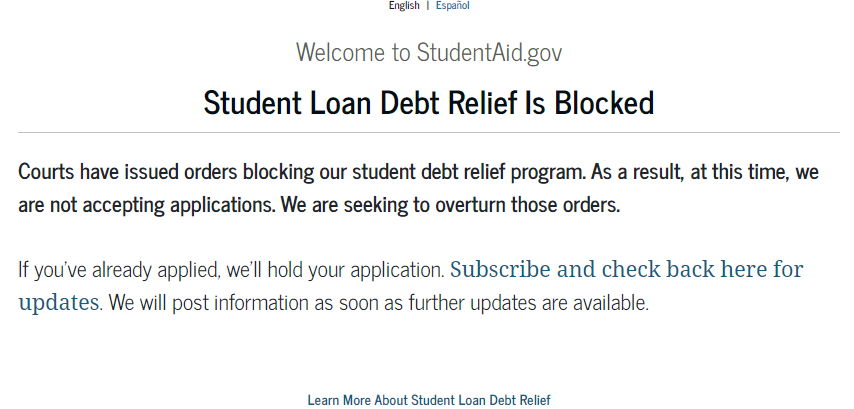

Though the application process is on hold, we will continue to update you with the latest news. You can subscribe to the Department of Education's email list and check for updates by visiting their website

Subscriptions | U.S. Department of Education.

To be eligible for debt relief:

- Annual income must fall below £125,000 for individuals or £250,000 for married couples.

- Individuals who received a Pell Grant in college with the income as mentioned before will be eligible for up to £20,000.

- Individuals who have not received a Pell Grant with the eligible income will receive up to £10,000.

To learn more about other forms of relief, please visit

Student Loan Forgiveness | Federal Student Aid.

Part 3: Managing the student loan system for future and current borrowers

An additional rule was established by the administration to create a new income-driven repayment plan to reduce future monthly payments for lower- and middle-income borrowers. This rule would:

- Borrowers pay no more than 5% of their discretionary income monthly on undergrad loans.

- Raise the amount of income that's considered non-discretionary income.

- Forgive loan balances after 10 years of payments.

- Cover borrower's unpaid monthly interest so no borrower's loan balance will grow if they make monthly payments.

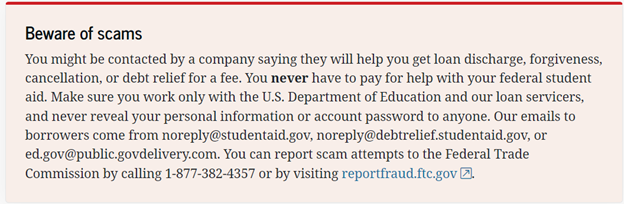

Beware of Scams

While student debt relief applications are being taken, please be aware of potential scammers. You will never have to pay for help with your student debt relief. Never share your login information or password with anyone. Please report scam attempts to the Federal Trade Commission at 1 (877) 382-4357.